Overview

- Producing gold-silver mine in Sonora

- Entered into production in Q4-2021

- 2023 production of 100,000 ounces gold and 1.2 million ounces silver

- 2024 production guidance for Santa Elena/Ermitaño of 81,000 - 90,000 ounces gold and 1.1 - 1.2 million ounces silver (estimated over 90% of production from Ermitaño)

- 10,000 metres underground development and 59,000 metres exploration drilling on the Santa Elena Complex budgeted for 2024

Latest Project Updates

Production at the Santa Elena mine transitioned to 100% Ermitaño ore sine the beginning of 2023. For the quarter ended September 30, 2023, 226,292 tonnes were processed containing average silver and gold head grades of 75 grams per tonne (“g/t”) and 4.09 g/t, respectively, producing 347,941 ounces silver and 28,367 ounces gold. This represents a total production increase of 49% compared to the previous quarter and this was due to higher grades and record silver and gold recoveries at Ermitaño averaging 64% and 95%, respectively, compared to 52% and 94%, respectively, in the previous quarter. The higher recovery rates were the result of the new dual-circuit plant, which allows for finer grinding and full utilization of the high intensity grinding mill.

For the nine-month period ended September 30, 2023, 648,991 (2022 - 644,785) tonnes were processed with average silver and gold head grades of 49 (2022 - 66) g/t and 3.74 (2022 - 3.56) g/t, respectively. Producing 594,107 (2022 - 1,030,224) ounces silver and 72,479 (2022 - 68,854) ounces gold. Recoveries were 58% (2022 - 75%) and 93% (2022 - 93%) for silver and gold, respectively. Total production for the second quarter decreased 15% and this was primarily due to lower gold grades compared to the previous quarter.

All ore deliveries were from the Ermitaño mine as the Santa Elena mine production was suspended to focus on exploration and definition drilling.

During the period, a total of 2,609 metres of underground development was completed at the Ermitaño mine, compared to 3,042 metres in the previous quarter. Up to four drill rigs consisting of two surface rigs and two underground rigs completed 9,237 metres of exploration drilling in the region compared to 16,373 metres in the previous quarter. The total exploration costs were $2.0 million compared to $2.9 million in the previous quarter.

Technical Report

A copy of the Ermitaño NI 43‐101 Technical Report can be found here.

Source of Measured and Indicated resource table: https://www.firstmajestic.com/projects/exploration-development/ermitano/

History

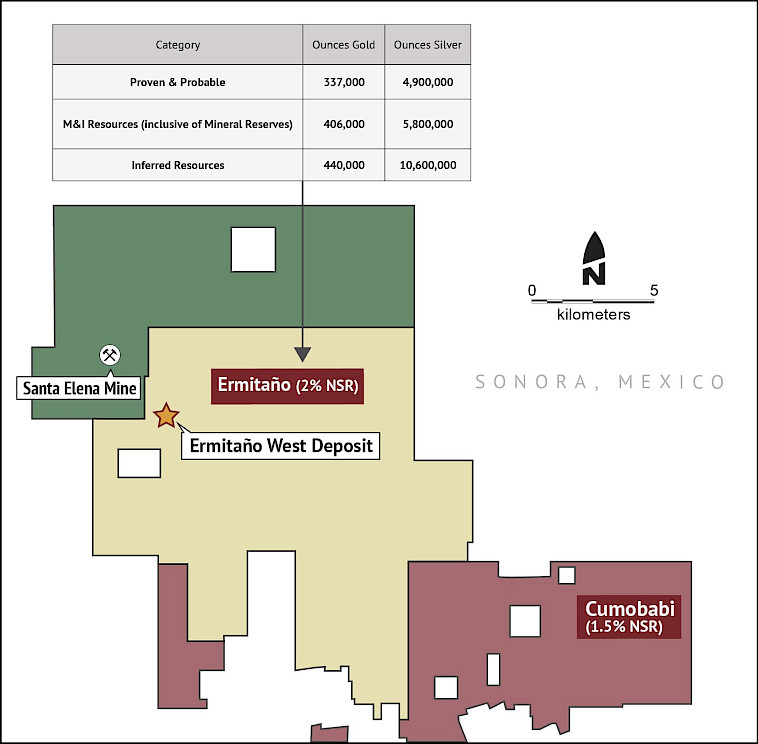

First Majestic Silver Corp. (“First Majestic”) completed its earn‐in in and paid US$1.5 million to acquire 100% interest in both the Ermitaño and Cumobabi projects in September 2018. Orogen retains a 2.0% net smelter return (“NSR”) royalty for Ermitaño and 1.5% NSR royalty on Cumobabi. To complete its earn‐in, First Majestic paid US$75,000 on agreement date and US$50,000 each anniversary thereafter in addition to completing over US$500,000 in exploration expenditures in the first year.

The Ermitaño Property consists of 167 square kilometres of contiguous mineral tenure located approximately 145 kilometres from Hermosillo and only 3.5 kilometres southeast of First Majestic’s Santa Elena gold‐silver mine in Sonora, Mexico.

Royalty Generation Timeline

- Ermitaño was acquired by Orogen in 2011

- Partnered to Inmet/FQM 2011‐2014

- Partnered to Silvercrest Mines Inc. (“Silvercrest”) in 2014

- First Majestic acquired Silvercrest in 2015

- Orogen invested a total estimate of $100,000 into Ermitaño from acquisition to completion of earn‐in with First Majestic

- Silvercrest and First Majestic together have spent an estimated $80M on the project

- NI 43‐101 Pre‐Feasibility Study Technical Report, June 30, 2021 was filed by First Majestic on November 24, 2021

- Initial production commenced in November 2021 and commercial production ramp up in Q1 2022